The lease expiration profile report is a detailed list that breaks down when the leases in a portfolio end. It shows the timing and concentration of the lease expirations in a property, which allows us to predict the turnover and income stability of your property portfolio.

Why is it important to spread your lease expiration dates as a property owner?

Spreading your lease expiration dates is the most effective strategy to prevent cash flow crises and protect asset value. A property with simultaneous expirations risks total vacancy, forcing urgent leasing at below-market rates that destabilizes your income.

A good lease renewal strategy not only helps you fill units, but most importantly gives you the power to predict your income, eliminate crisis management, and maximize your property’s long-term value. By avoiding the need to lower rent prices in a crisis, you can negotiate on your own terms and protect your asset value.

How do lease expiration profiles impact real estate investment decisions?

Lease expiration profiles directly determine your portfolio’s risk exposure and income predictability. For example, in rental markets that continue to experience low vacancy rates, like with Dutchess County, a cluster of lease expirations can force you to compete against yourself, lowering rents and tenant quality just to fill units.

In Dutchess County, New York, the number of multi-family units being built is increasing rapidly since 2020, yet the county’s vacancy rate in 2024 is three percent below the healthy vacancy rate, impacting asset stability.

Even though a low vacancy rate is fundamentally good for business, it’s a risk when leases expire in a cluster. In this scenario, a 10-unit building where 4 leases expire in the same month transforms into a crisis. This occurs the moment you have to list and lease 4 identical units in the same narrow timeframe. Each unit you own competes with itself, forcing you to accept lower rents and weaker tenant profiles to avoid extended vacancies. Staggering your lease renewals helps you efficiently avoid this crisis and retain your income.

3 Steps To Calculate And Analyze Your Lease Expiration Profile Portfolio

The following case illustrates how to build a Lease Renewal Strategy for property owners across the Hudson Valley region and surrounding counties, serving both New York and Connecticut markets:

🔹Step 1: How Do You Generate A Lease Expiration Profile Report?

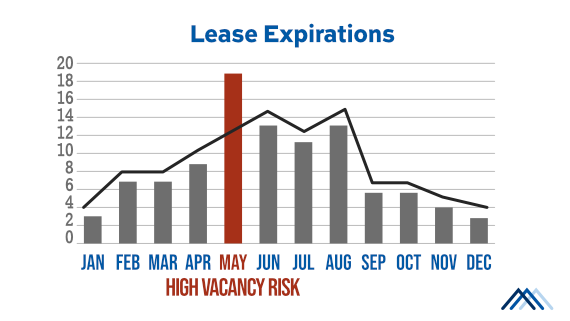

To generate a property’s lease expiration profile report, we gather every lease agreement and plot each expiration date on a 12-month calendar. A healthy profile shows lease expiration dates that space out evenly throughout the year. On the other hand, a clustered profile has multiple leases expiring in the same 1 or 2 month window, this is the red flag we identify.

This step helps you determine the consecutive 60 day window within the next 12 months where the highest number of leases expire; the moment you are at maximum risk of multiple, simultaneous vacancies that can devastate your cash flow.

🔹Step 2: How Do You Calculate Property Vacancy Risk?

To calculate the risk of total vacancy in a property within the cluster concentration timeframe, identify the most vulnerable financial point of your lease expiration profile, then use a formula to calculate the total vacancy risk of the multi-family portfolio.

Use this formula to calculate total vacancy risk within a portfolio:

(Number of leases expiring in your busiest 60-day window / Total number of units) x 100

Learn how to Interpret the total vacancy risk score:

• < 15-20% the total vacancy risk is low

• > 30-40% the total vacancy risk is high

When the total vacancy risk is high, it requires immediate action to stagger renewals.

🔹Step 3: How Do You Comply with Lease Renewal Notice Laws?

Navigating renewal laws is where strategy meets compliance. Missing a deadline can forfeit your right to increase rent or even renew the lease at all. Here’s what you need to know to stay compliant with your local laws.

Colonial Property Management services ensure legal compliance in New York and Connecticut. Our lease renewal strategies are built with all applicable notice period laws in mind.

What are the standard notice periods in New York?

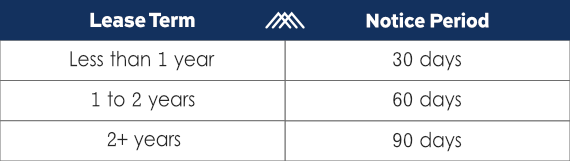

For market-rate apartments, New York State law requires written notice for renewal or a rent increase over 5%. The timeline depends on your tenancy length:

When does the timeline change? Your compliance depends on three key factors:

Is the unit rent-stabilized? This is the most critical factor. The law requires you to offer a renewal lease 90 to 150 days before the current lease expires. The tenant then has 60 days to accept. Missing this window can completely block a rent increase.

Is the property in a “Good Cause” municipality? Cities like Albany, Kingston, and Newburgh have local laws that often extend these notice requirements to more tenants, applying the same market-rate standards even without a large rent increase.

How is the tenant’s “length of stay” calculated? The law requires using the longer of the lease term or the tenant’s total continuous time in the unit. A tenant on a 1-year lease who has lived there for 3 years is entitled to 90 days’ notice.

For property owners, this means your planning timeline is set by your most restrictive lease. While planning 90 days ahead is a general rule, portfolios with rent-stabilized units or properties in “Good Cause” areas must start the renewal process 150 days or more in advance.

How Colonial Property Management Ensures You Stay Compliant:

Tracking these varying rules across a portfolio is a complex, high-risk task. This is where our expertise becomes your strategic advantage. Colonial Property Management simplifies the entire process by acting as your dedicated property manager.

Our comprehensive property management services includes:

1. Real-Time Notifications: We monitor your lease expiration profile and provide clear timelines.

2. Lease Renewal Assistance: We identify all legal deadlines and handle tenant outreach.

3. Legal Compliance: We ensure every action is lawful, transforming a complex requirement into a seamless strategy that protects your passive income.